vanguard intermediate term tax exempt bond index fund

Vanguard Intermediate-Term Tax-Exempt Bond is managed by diligent leaders through a sensible and risk-conscious investment process and benefits from ultra-low fees. VBIIX A complete Vanguard Intermediate-Term Bond Index FundInvestor mutual fund overview by MarketWatch.

Vanguard Tax Exempt Bond Funds Are They Worth It Bogleheads Org

To see the profile for a specific Vanguard mutual fund ETF or 529.

. 1 as a core. The Vanguard Intermediate Term Bond Index Fund is usually considered a candidate for placement in tax advantaged accounts. The Vanguard Intermediate-Term Tax-Exempt fund falls within Morningstars muni national intermediate category.

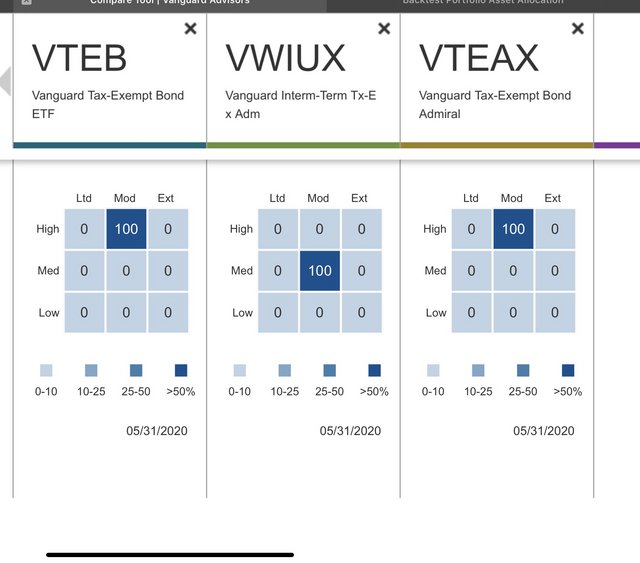

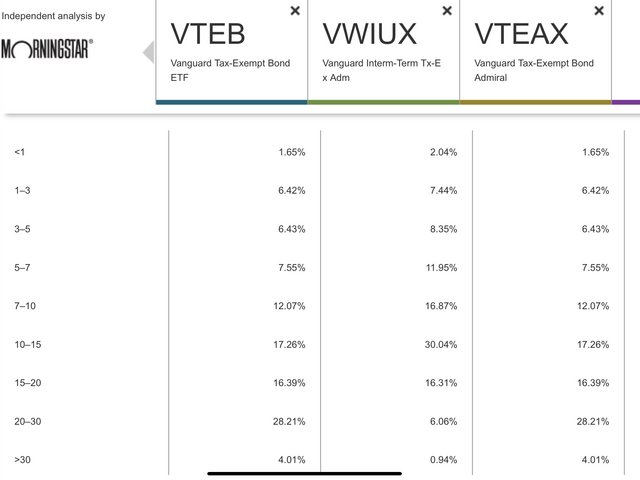

Bond funds Tax-Exempt Bond Index Fund VTEAX 009 Tax-Exempt Bond ETF VTEB 008 11. Decide which type of account. VanguardIntermediate-Term Tax-Exempt Fund Bond fundAdmiral Shares Fund facts Risk level Low High Total net assets Expense ratio as of 022522 Ticker symbol Turnover rate Inception.

Ad We Work Closely With You To Create A Personalized Plan To Help You Reach Your Goals. Advice Powered By Relationships Not Commissions From A Financial Advisor You Can Trust. Advice Powered By Relationships Not Commissions From A Financial Advisor You Can Trust.

Actual after-tax returns depend on your tax situation and are not relevant if you hold shares through tax-deferred arrangements such as IRAs or 401 k plans. Bond funds are subject to the risk that an issuer will fail to make payments on time and that bond prices will decline because. While other tools may compare funds only to the SP 500 or 500 Index fund you can use this tool to determine how closely the performance of one Vanguard stock fund tracks that of any.

Intermediate-Term Corporate Bond Index Fund VICSX Intermediate-Term. Intermediate-Term Bond Index Fund Admiral Shares. View mutual fund news mutual fund market and mutual fund interest rates.

Simplify your finances with any of the following optional services for this fund. California Intermediate-Term Tax-Exempt Fund 100. Ad We Work Closely With You To Create A Personalized Plan To Help You Reach Your Goals.

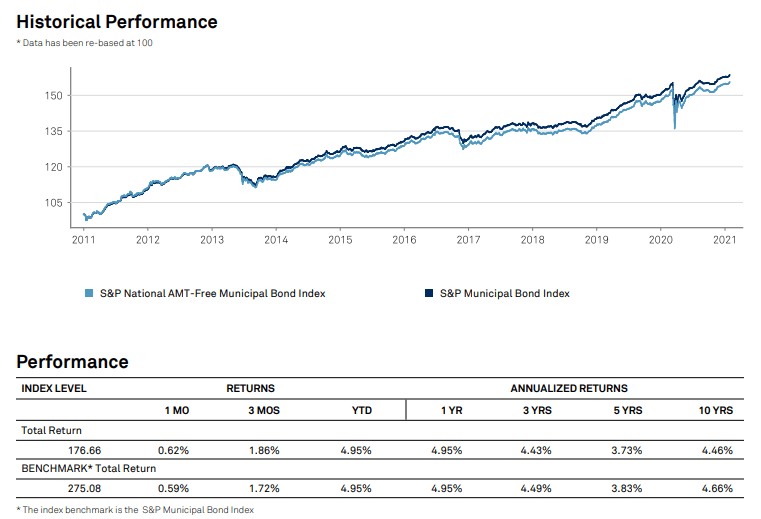

Vanguard Intermediate-Term Tax-Exempt Fund seeks to provide a moderate and sustainable level of current income that is exempt from federal personal income taxes. Choose your mutual funds. This index includes municipal bonds from issuers that are primarily state or local governments or agencies whose interest is exempt from US.

Bond funds and Vanguard Tax-Managed Balanced Fund. Stay up to date with the current NAV star rating. The fund is often recommended see Fig.

Federal income taxes and the federal alternative. Write checks for 250 or more from your Vanguard nonretirement. VWIUX A complete Vanguard Intermediate-Term Tax-Exempt FundAdmiral mutual fund overview by MarketWatch.

For mutual funds Indiana. Vanguard Intermediate-Term Tax-Exempt Fund. VWITX - Profile.

XNAS quote with Morningstars data and independent analysis. Vanguard Tax-Exempt Bond Index Fund Admiral Shares VTEAX This index fund provides broad exposure to US. 2012 is exempt from Indiana income tax.

The Vanguard Intermediate-Term Tax-Exempt fund falls within Morningstars muni national intermediate category. Vanguard Total Bond Market Index Fund VBTLX The first in. VBILX Intermediate-Term Bond Index Fund Admiral Shares.

Vanguard Intermediate-Term Bond Index Fund Investor Shares VBIIX The Funds statutory Prospectus and Statement of Additional Information dated April 29 2022 as may be amended. Summary prospectus Fact sheet Compare product. Vanguard Short Term Tax Exempt Fund.

View mutual fund news mutual fund market and mutual fund. Contact us Sign in Register. Find the latest Vanguard Interm-Term Bond Index Inv VBIIX.

At least 75 of the securities held by the fund are municipal. Municipal bonds are issued by states and municipalities to. Following is a list of the best Vanguard bond funds to choose from so you can make an informed decision.

It invests in investment. Vanguard Intermediate-Term Investment Grade Fund. VCAIX - Vanguard California Intermediate-Term Tax-Exempt Fund Investor Shares Vanguard Advisors.

Open an account in 3 steps. Municipal bonds are issued by states and municipalities to. Vanguard and Morningstar Inc as of December 31 2020.

The Vanguard Intermediate-Term Tax-Exempt Fund Investor Shares is a municipal bond fund that aims to provide investors with a moderate but sustainable level of federally tax.

Top 10 Best Tax Free Municipal Bond Mutual Funds Mutuals Funds Bond Funds Fund

Municipal Bond Yields A Renaissance Of Tax Exempt Income

2 Questions About Vanguard S Tax Exempt Bond Index Bogleheads Org

10 Best Intermediate Municipal Bond Funds For The Long Term Mutual Funds Us News

Vteb Vanguard Tax Exempt Bond Etf Provides 2 Yield With Less Interest Rate Risk Than Many Bond Funds Nysearca Vteb Seeking Alpha

Vanguard High Yield Tax Exempt Don T Call It Junk Kiplinger

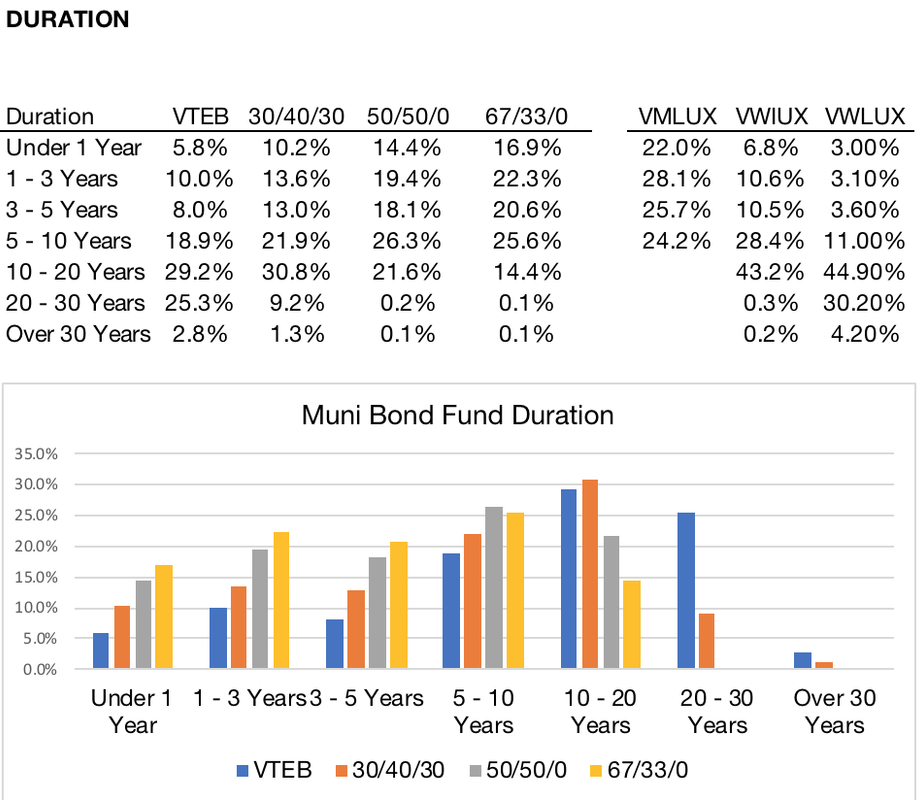

Our Approach To Tax Exempt Portfolio Allocation Seeking Alpha

Should I Bother With Tax Exempt Bond Bogleheads Org

Vanguard Total Bond Market Index Fund Tax Distributions Bogleheads

Vteb Vanguard Tax Exempt Bond Etf Vanguard Advisors

Vteax Vanguard Tax Exempt Bond Index Fund Admiral Shares Portfolio Holdings Aum 13f 13g

Vanguard Tax Exempt Bond Index Fund Etf Vteb Stock Price News Google Finance

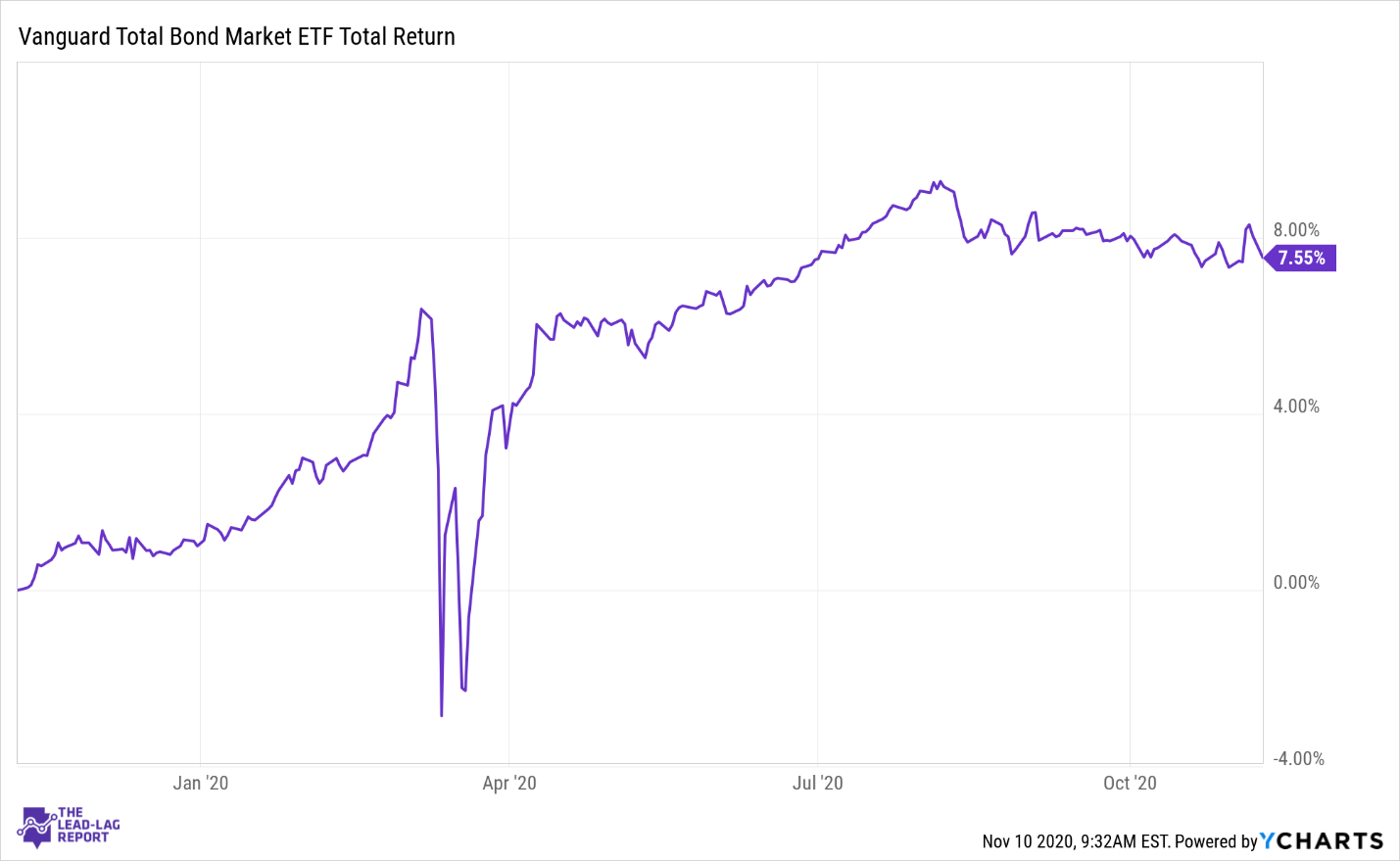

Vteb Vanguard Tax Exempt Bond Etf Provides 2 Yield With Less Interest Rate Risk Than Many Bond Funds Nysearca Vteb Seeking Alpha

Vteb Vanguard Tax Exempt Bond Etf Provides 2 Yield With Less Interest Rate Risk Than Many Bond Funds Nysearca Vteb Seeking Alpha

Municipal Bond Yields A Renaissance Of Tax Exempt Income

2 Questions About Vanguard S Tax Exempt Bond Index Bogleheads Org

Vanguard Total Bond Market Etf A Good Return In Safe Hands Nasdaq Bnd Seeking Alpha

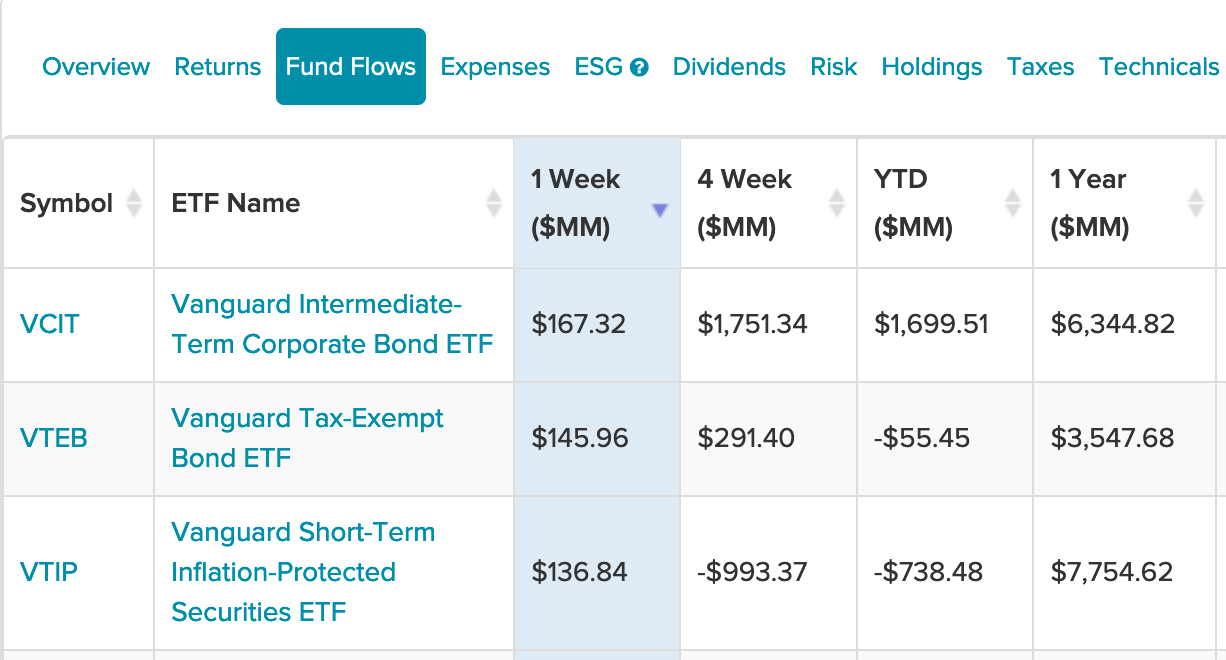

What The Past Week S Inflows For Vanguard S Bond Etfs Are Saying

Vwitx Vanguard Intermediate Term Tax Exempt Fund Investor Shares Vanguard Advisors